Yves here. Wolf does a public service in providing a short unpacking of what happened with the “protect investors from the Covid meltdown” special purpose vehicles that would buy junk bonds and stocks and be managed by BlackRock. The short answer is that this was a successful application of the Hank Paulson bazooka principle:Nevertheless, Paulson’s bazooka failed. He had to take over Fannie and Freddie about two months later. However, “Super Mario” Draghi was a master of this sort of thing. One of his programs that goosed Eurobond prices at a time when they were wobbly was the OMT, for “Outright Monetary Transactions”. Doing Paulson (and later Mnuchin) one better, Draghi didn’t get a single new power. He just took existing programs and gave them a new name!It’s also telling that even an investor like Wolf doubts the wisdom of bailing out Wall Street rather than Main Street and households.Why do bondholders and leveraged speculators have to be enriched, instead of providing fiscal relief to the unemployed and small businesses? Thats the question.Fed Chair Jerome Powell replied on Friday afternoon with his own Dear Mr. Secretary letter to Treasury Secretary Steven Mnuchins Dear Chair Powell letter on Thursday. Both letters were full of compliments for the other and for their cooperation and for their success in inflating asset prices. But with regards to asset prices in the credit markets, Mnuchins letter gave specific metrics and said enough is enough. And Powells letter said, OK, the Treasury can have the taxpayer money back that it sent us.Youd think something earth-shattering happened based on the media hullabaloo that ensued.On Thursday afternoon, Mnuchin informed the Fed of two things: One that he would not extend again the already extended expiration date of December 31 of five of the controversial over-the-line Special Purpose Vehicles (SPVs) the Fed had set up earlier this year under the direction of the Treasury to bail out and enrich bondholders, particularly junk-bond holders and speculators with huge leveraged bets; and two, that he wants the Fed to return the $455 billion in taxpayer money the Treasury had sent to the Fed to fund these SPVs with equity capital, and that the Fed has not used.The actual bond purchases the Fed did under these five SPVs were minuscule by Fed standards, whose balance sheet is measured in trillions of dollars. Those SPVs were mostly used as a jawboning tool to inflate asset prices.

Between the Feds first announcement of these SPVs in March and the end of October, the Fed bought just $22.6 billion under these five programs, including corporate bonds, corporate bond ETFs, asset-backed securities, municipal bonds, and bank loans to main-street businesses, a minuscule amount considering its $7.24 trillion with a T in total assets. Specifically, it bought:

- $13.3 billion under the SPV the Fed calls Corporate Credit Facilities (CCF), which combines the PMCCF and the SMCCF under which the Fed buys corporate bonds, corporate junk bonds, corporate bond ETFs, and junk-bond ETFs.

- $3.8 billion under TALF (Term Asset-Backed Securities Loan Facility) under which the Fed lends to speculators for them to buy asset-backed securities and place those securities as collateral at the Fed, on a nonrecourse basis, meaning theres zero risk for investors, and they get all the gains.

- $1.6 billion under MLF (Municipal Liquidity Facility) under which the Fed lends to municipalities.

- $3.9 billion under MSLP (Main Street Lending Program), where the Fed supports banks to make loans to small businesses.

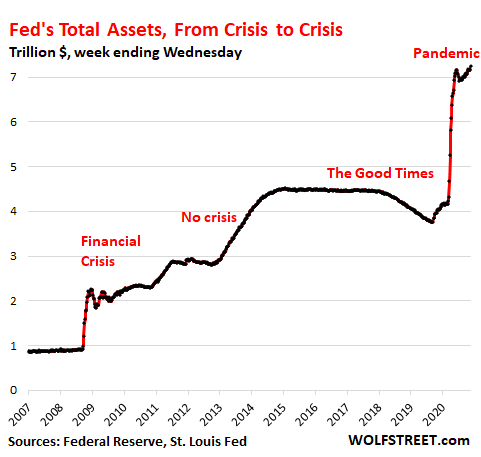

The total assets on the Feds balance sheet as of Wednesday amounted to $7.24 trillion, a tad higher than on June 10, with a dip in the middle. Of that $7.24 trillion in assets, the $22.6 billion in these to be expiring SPVs is so small that it cannot even be marked into this chart:

In his letter on Thursday, Mnuchin listed 12 key financial metrics to show that those SPVs did accomplish their goal of bailing out and enriching bondholders and leveraged speculators, and in the process, they created wondrous credit markets that are now frothing at the mouth.

And the Fed did it, as Mnuchin acknowledged, almost exclusively through hype and jawboning, instead of actually buying the corporate bonds and other instruments. And most of the money the Treasury had sent remained unused, and could now be used for direct Covid-related fiscal relief by the government instead of enriching bondholders via the Fed.

In an interview on CNBC, Mnuchin, after being accused of playing political games, said all the right things maybe for the wrong reasons when discussing why hed let these five SPVs expire as planned:

Were not trying to hinder anything. Were following the law, he said. I am being prudent and returning the money to Congress like Im supposed to, he said. This is not a political decision. And he said, The people that really need support right now are not the rich corporations, it is the small businesses.

Powell himself has been badgering Congress for months to provide more fiscal support to small businesses and other entities because the Fed was not well suited to do so, which was the reason the Main Street Lending Program (MSLP) never really got off the ground.

OK, what Mnuchin didnt say was that bondholders and bond-speculators have gotten immensely rich by the markets reaction to the March announcement of these SPVs and the hype and jawboning that came along with it, as bond prices surged across the board.

Powell in his Dear Mr. Secretary letter on Friday afternoon told Mnuchin after going through the same kind of mutual back-slapping Mnuchin had gone through that the Fed would return those taxpayer funds to the Treasury. He said:

You have indicated that the limits on your authority do not permit the CARES Act facilities to make new loans or purchase new assets after December 31, 2020, and you have requested that we return Treasurys excess capital in the CARES Act facilities. We will work out arrangements with you for returning the unused portions of the funds allocated to the CARES Act facilities in connection with their year-end termination.

And he added:

As you noted in your letter, non-CARES Act funds remain in the Exchange Stabilization Fund and are, as always, available, to the extent permitted by law, to capitalize any Federal Reserve lending facilities that are needed to maintain financial stability and support the economy.

But given how small the actual amounts were in these SPVs, and given the magnitude of its QE binge $3 trillion in three months it is clear that letting these essentially unused facilities expire as planned isnt going to matter to the real economy, though it might matter a little to the speculators and investors who got rich off the jawboning, but they had it so good for so long and they shouldnt complain.

But returning $455 billion to the Treasury and having Congress fashion new fiscal aid programs for Covid relief to small businesses and the unemployed would make a huge difference. Why do bondholders and speculators have to be coddled all the time to further increase the wealth disparity, instead of providing a modicum of fiscal relief to the unemployed and struggling small businesses? Powell didnt even attempt to explain that.

Those SPVs should have never been concocted in the first place. Theyre just another subversion of the credit markets designed to enrich asset holders.

The Fed should have never been allowed to buy corporate bonds and corporate bond ETFs, which trade on the stock market. But it did so anyway for the first time ever. Back during the Financial Crisis, it should have never been allowed to buy mortgage-backed securities, but it did for the first time ever, and now its standard policy and a $2-trillion line-item on the Feds balance sheet.

What these asset purchases accomplished was to increase the horrendous wealth disparity the wealth effect, as Bernanke, when he was still Fed chair, rationalized it, and a term Yellen touted when she was president of the San Francisco Fed. But blame for this horrendous wealth disparity via the Feds asset purchases lies with Congress which has authority over the Fed.read more